Across Australia, digital platforms are becoming the central hub for how small businesses operate, transact, and grow. Whether it’s a marketplace, SaaS platform, or industry-specific management tool, users now expect more than the app’s or service’s base functionality. Modern demands include financial services at the point of service access. That’s why partnering with an embedded finance provider has quickly become a strategic advantage for platforms wanting to expand value without building financial infrastructure from scratch.

Through API-driven lending tools and seamless integration options, embedded finance provider enables platforms to offer fast, flexible business funding directly within their existing user experience.

In this article, we’ll break down what embedded finance actually means, how embedded finance solution works, the benefits for Australian platforms, and what regulatory or tax considerations local businesses need to keep in mind.

What Is Embedded Finance?

Embedded finance refers to the integration of financial services, such as lending, payments, or insurance, within a non-financial platform. This keeps users within the platforms they already use.

Instead of sending customers to a bank or lender, a platform can integrate funding options directly into its workflow through an embedded finance provider.

This model has grown rapidly as more Australian SMEs demand convenience, speed, and transparency when securing working capital.

Traditional lenders and banks often require extensive documentation and slow approval processes, which may not always suit businesses facing cash-flow pressures or seasonal fluctuations.

Platforms also benefit from this shift. By embedding finance, they create a smoother customer experience and offer tools that help users grow, making the platform more valuable.

In a competitive digital landscape, offering integrated lending can be the differentiator that keeps users engaged and loyal.

How Embedded Finance Solution Works

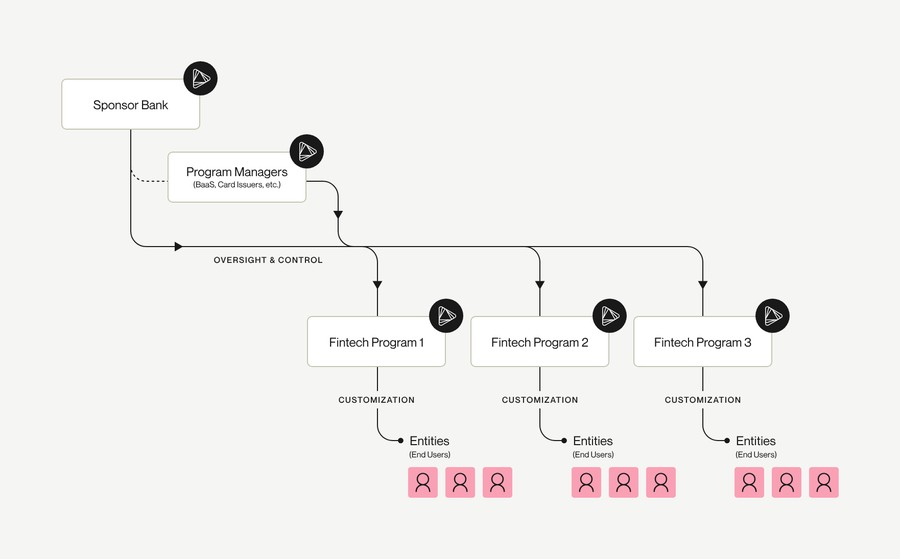

Embedded finance solutions empowers platforms to offer business loans and lines of credit without becoming lenders themselves.

Here’s how the process works from end to end.

Step 1: Secure Data Sharing Through API

Platforms can send anonymised business information, such as trading history, industry type, or transaction patterns, directly to embedded finance providers via an API. This enables them to instantly assess eligibility without requiring users to complete lengthy forms on an external website.

Step 2: Pre-Qualified Offers Returned In Real Time

Using automated credit checks and decisioning tools, embedded finance providers return pre-qualified funding options for the platform to display.

Depending on the platform partner’s requirements, a variety of information can be shared. This includes the loan amount, terms, and estimated pricing. This allows users to instantly see what funding may be available to them, improving engagement and conversion.

Step 3: In-Platform Completion Of the Application

If a user chooses to continue the process, the platform can collect their business details, such as their ABN, contact information, and required consents.

Embedded finance providers then performs complete credit evaluations and final assessments before issuing digital loan documentation.

Step 4: Fast Funding And Ongoing Visibility

Approved SMEs receive funds directly into their business account, often within the same or next business day.

Throughout this process, platforms don’t carry the compliance, risk management, or operational responsibilities of lending. Embedded finance providers handle these obligations as the licensed lender, while the platform focuses on delivering a consistent branded experience.

The Benefits For Australian Platform Partners

Working with embedded finance providers give platforms several strategic advantages that extend far beyond simply offering loans to users.

New Revenue Streams

Platforms earn commissions or referral fees from every funded customer, creating a new, scalable revenue stream without charging subscription fees or investing in their own financial infrastructure. This offers a safe and predictable upside as user adoption grows.

Improved Customer Loyalty

When users can access finance without leaving the platform, they’re more likely to stay engaged. This increases retention, reduces churn, and positions the platform as an all-in-one business support ecosystem.

Faster Access To Funding For SMEs

Many Australian small businesses face cash-flow strain throughout the year. Lenders’ fast approvals and flexible loan structures help SMEs secure essential working capital without long delays or complex processes.

API-Driven Scalability

Embedded finance providers’ API-first approach lets platforms launch with minimal development overhead and scale as user demand increases. Whether a partner has hundreds or thousands of users, the infrastructure expands alongside the platform.

Risk Reduction And Compliance Support

Because the lenders serve as the regulated embedded finance provider, platforms can avoid the licensing, legal, and compliance burdens associated with offering financial products independently.

This is particularly relevant in Australia, where financial service providers are required to comply with stringent financial regulatory requirements.

Embedded lending is a strategic capability that strengthens the platform’s overall business model.

Considerations For Platforms

Before integrating finance into a digital ecosystem, Australian platforms should consider several key factors.

Regulatory Obligations

Australia’s financial services sector is regulated, and businesses offering lending or credit products typically require proper licensing.

By partnering with an embedded finance provider, platforms can avoid the need to obtain their own licences. Instead, the lenders act as the embedded finance provider responsible for compliance, credit assessment, and regulatory oversight.

Tax And Reporting Requirements

According to the ATO, Australian businesses are required to maintain accurate tax records, meet their GST obligations where applicable, and report their income accurately.

Key reminders include:

- Businesses are required to retain financial and business records for a minimum of five years (ATO requirement).

- Platforms that earn commissions from embedded finance partnerships must treat them as assessable income.

- SMEs receiving loans must still meet all applicable tax obligations. Borrowing money does not replace GST, PAYG, or other responsibilities.

Data Protection And Consent

Platforms must ensure they comply with Australian privacy standards when sharing data. Embedded finance providers’ integration supports anonymised data transfer for initial assessments and ensures that user consent is captured during applications.

Transparency With Users

Clear communication regarding fees, terms, and the platform’s role in the lending process helps reduce confusion and reinforces trust. This is an essential factor in any embedded finance rollout.

Why Partnering With An Embedded Finance Provider Built for Australian SMEs

Embedded finance providers are often leading fintechs, non-bank lenders who understand the realities of the local SME landscape and the challenges businesses face.

They specialises in helping small businesses access working capital quickly, with flexible funding options designed around real-world trading conditions.

This makes embedded finance provider a good fit for platforms serving trades, e-commerce sellers, hospitality businesses, professional services, and more.

Fast Time To Market

Developer-friendly APIs, detailed documentation, and hands-on support reduce the technical lift.

Platforms can embed financing under their own brand, maintaining a seamless user journey. This enables the offering of lending without compromising the platform’s identity or interface.

A Partnership Approach

Embedded finance providers offers ongoing support, insights, and transparency, helping platforms refine their embedded lending strategy over time. This strengthens long-term value for both the platform and its user base.

In a market where businesses expect frictionless services, these lenders offer a turnkey solution that allows platforms to act quickly and confidently.

Conclusion

Embedded finance has become a powerful tool for Australian platforms seeking to grow revenue, enhance customer loyalty, and better support the small businesses that rely on them.

By partnering an embedded finance provider, platforms can deliver fast and reliable lending solutions without incurring regulatory or operational burdens.

They bring local expertise, modern technology, and a partnership mindset, making it an ideal choice for platforms looking to offer funding in a competitive digital environment.